Young People in These G7 Countries are Interested in Investing and Find Savings Accounts ‘Sexy’ – New Poll

Survey data from two of the G7 countries show that financial planning and fiscal responsibility are attractive to a potential partner.

In America, a large survey showed that significant numbers of younger people find having a savings account sexy.

Meanwhile in Japan, a three-fourths majority of surveyed high schoolers said they were keenly interested in investing, and even at such a tender age, almost 5% had already started.

Private savings aren’t just a responsible thing for an individual or couple to maintain in order to have a secure life, they are the singular cause of wealth in human society.

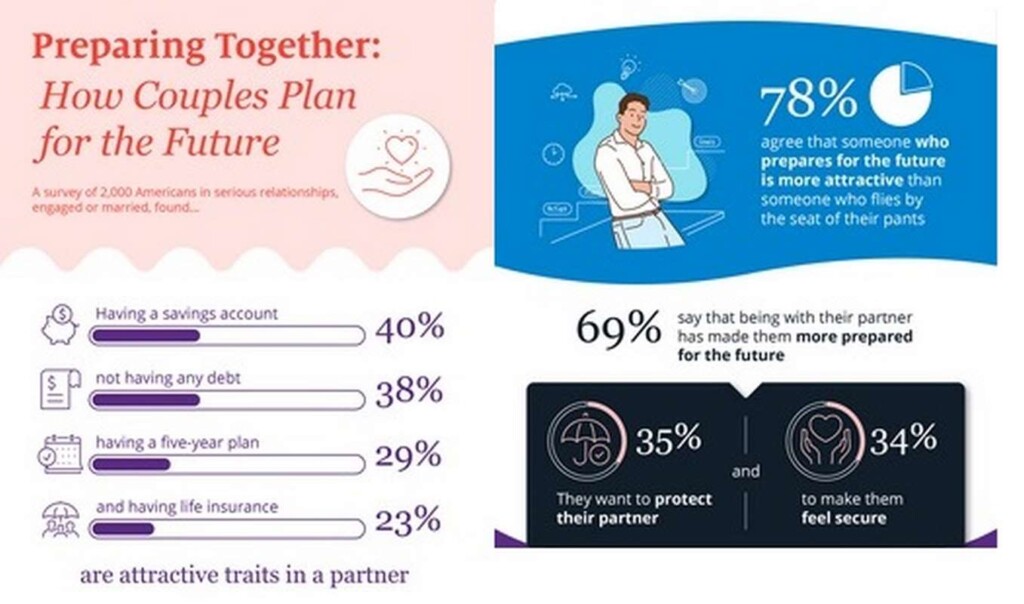

According to a OnePoll survey of 2,000 U.S. adults in serious relationships, engaged or married, having a savings account (40%), not having any debt (38%), and having a five-year plan (29%) are all attractive traits in a partner.

78% of respondents agreed that someone who prepares for the future is more attractive than someone who flies by the seat of their pants.

More than two-thirds (69%) attribute their preparedness to their partner—either putting these plans in place to protect them (35%) or to make them feel secure (34%).

Conducted on behalf of Assurance IQ, the survey also looked to uncover how love changes as you grow older and how couples are preparing for the future together.

FOR THOSE INTERESTED IN INVESTING: Lack of Financial Literacy in Schools Inspires Launch of Podcast to Teach People How to Protect Their Wealth

The second survey, conducted by Studyplus Trend Kenkyujo, the research arm of Tokyo-based education-related service provider Studyplus Inc., found that more than 70% of high school students in Japan are interested in investing, and 4.7% have already started.

Thanks to the magic of compounding, the earlier a person can start investing or saving, the more money they will have when they decide not to work anymore.

The study proffered a questionnaire to 512 high schoolers at the end of the 2023 academic year. Of the 4.7% who had already begun investing, 4.5% said they did so with the help of, or under the influence from, their parents or other relatives.

“Adults close to high school students, such as parents and teachers, need to create opportunities for them to properly learn about finance and guide them correctly,” the researchers said.

MORE IMPRESSIVE STATS ABOUT THE YOUTH: Youth Crime in the U.S. Has Plummeted 78% Since 1994, Which Counters the Usual Narrative

Financial literacy is a barren topic in American high schools, but unlike biology or algebra, it’s a skill they are 100% likely to need at some point.

Humans saving their wealth is what turned societies from tribes of hunter-gatherers into the complex technological marvels they are today. When people had savings, they had time to think, and when they had time to think, they invented better ways of living and working.

Fast-forward to modern society, and the same principle is present. Private wealth deposited in financial institutions like banks or funds allows those institutions to lend to people with ideas for how to make society better—to start businesses, to innovate, to expand, to construct bridges and other infrastructure.

This is the story of how Japan became the global manufacturing powerhouse of the second half of the 20th century—through constant savings and investment at rates as high as 18.2% for the average household.

The surveys suggest that maybe the world is in more responsible hands than the baby-boomer generation might imagine.

SHARE This Encouraging Data About Financial Trends Among Youth…

>read more at © GoodNews

Views: 3